- Amphitheater Public Schools

- Overview

Tax Credit

Page Navigation

-

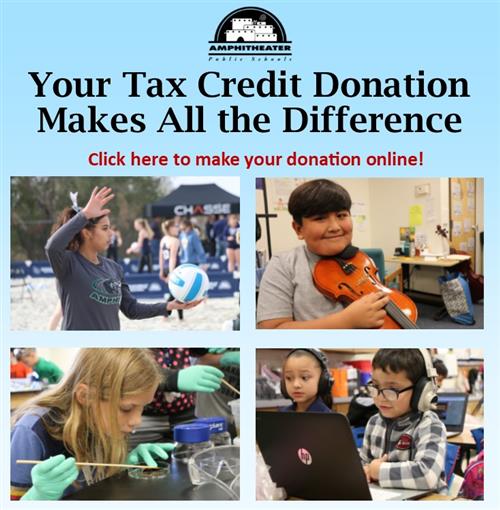

Thank you for your interest in supporting students through the Arizona Tax Credit!

For donation receipts, please check your Junk or Spam folders for an email from "noreply@intouchpay.com"

The Arizona State Tax Credit program allows you to make a donation to a public school and receive a dollar-for-dollar credit against your Arizona state taxes. Married couples filing jointly can contribute up to $400, and individuals can contribute up to $200 and get that donation back in full on their tax returns, provided they have at least that much tax liability.

School tax credit donations are used to supplement education through extracurricular activities that enhance children's lives and extend their learning. Students who play sports in school are more likely to stay in school and succeed academically. Children who participate in fine arts do better in basic academic subjects, including math, reading, writing and science.

Making a contribution is easy, and all donations have an incredible impact on student experiences.

A few notes:

- You can go online to make your contribution. You can direct your tax credit contribution to a specific school or program or even to an individual child's fees for extracurricular programs.

- If you would prefer to donate by check, you can visit any school or the District offices to make your contribution.

- The deadline for taking the tax credit on your return is the same as the deadline for submitting your tax return. Please be sure to make your donation before you file your tax return.

- Anyone who pays taxes in Arizona can make these tax credit donations. You do not have to have a child in school!

- We recommend you consult your tax professional for any questions about your particular situation and to be sure your donation qualifies for the tax credit.

For additional general information about the Tax Credit or for help with making a contribution, contact: Amphitheater Accounting Department at 520-696-5123 or e-mail cwadhams@amphi.com.

For donation receipts, please check your Junk or Spam folders for an email from "noreply@intouchpay.com"